Many leaseholders and car owners are unaware that standard insurance policies may not fully protect personal vehicle use, leaving them vulnerable to unexpected costs. Bobtail insurance coverage fills this gap by ensuring drivers are insured for personal trips, covering repair costs from mechanical failures not typically covered by standard policies. It's crucial for leasing a vehicle for personal use, protecting against damage or theft while not in business use, and addressing gaps in lease agreements. Eligibility varies among leasing companies, so reviewing contracts and discussing with insurers is essential. For mixed personal and business use, bobtail insurance is vital to protect against liability during loading/unloading or stationary use. Smart drivers should also secure comprehensive coverage, perform regular maintenance checks, and practice defensive driving techniques.

“Protecting your vehicles, whether leased or owned, during personal use is a crucial aspect of responsible car ownership. This comprehensive guide delves into essential strategies and insurances to safeguard your assets. We explore ‘Bobtail Insurance Coverage’ and its role in mitigating risks for personal vehicle use. Additionally, we provide insights on leasing protections and considerations for owned vehicles. By the end, you’ll be equipped with knowledge to maximize safety and savings while navigating daily commutes.”

Understanding Bobtail Insurance Coverage for Personal Use Vehicles

Many leaseholders and vehicle owners are unaware that their standard insurance policies might not adequately cover personal use of leased or owned cars. This is where bobtail insurance coverage plays a crucial role. Bobtail insurance is designed to fill the gap in protection when a vehicle is used for personal purposes outside of its intended commercial use. It ensures that drivers are insured against potential risks and liabilities arising from personal trips, whether it’s a quick run to the grocery store or a longer vacation.

This type of coverage is particularly important because personal use can sometimes lead to unforeseen circumstances. For instance, if your leased car experiences mechanical failure while on a personal trip, bobtail insurance can help cover repair costs that might not be covered by a standard policy. It provides peace of mind, knowing that you and your vehicle are protected during these transitions from commercial to personal use.

Leased Vehicle Protection: What You Need to Know

When it comes to protecting your leased vehicle during personal use, understanding your insurance options is crucial. Leased vehicles often come with specific coverage guidelines and exclusions that differ from traditional car insurance policies. One important aspect to consider is bobtail insurance coverage. This type of insurance is designed for individuals who drive their leased cars outside of work or business purposes, providing an additional layer of protection.

Bobtail insurance ensures that if your leased vehicle is damaged or stolen while not in service, you’re still covered. It fills the gap left by standard lease agreements, offering peace of mind and financial security. Keep in mind that policy details and eligibility criteria may vary between leasing companies, so it’s essential to review your lease contract and consult with your insurance provider to ensure you have the appropriate bobtail insurance coverage.

Additional Considerations for Owned Vehicles Used Personally

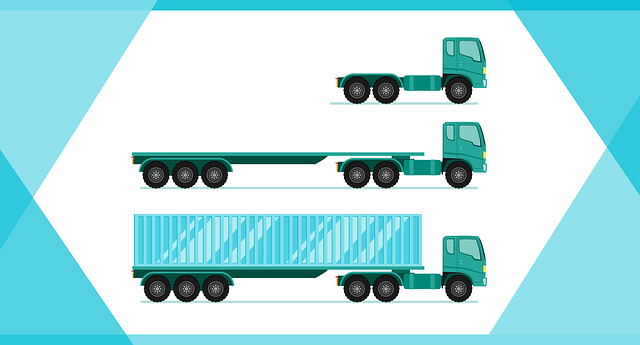

When it comes to protecting your personally used owned vehicles, there are unique considerations beyond the standard insurance policies. If you use your personal vehicle for business purposes or occasional leisure, ensuring adequate coverage is paramount. One crucial aspect to consider is bobtail insurance coverage. This specific type of policy is designed for when a truck or trailer is being pulled and not in operation. It offers liability protection for incidents that may occur during loading, unloading, or while the vehicle is stationary but still connected.

For instance, if you own a vehicle and occasionally drive it for personal travel, checking your insurance policy to understand bobtail coverage can be enlightening. Many standard policies exclude personal use, so having specialized coverage ensures protection in various scenarios. This is especially true if your vehicle has a trailer attached, as the bobtail insurance will account for unique risks associated with such setups, providing peace of mind while navigating different types of personal and business-related driving situations.

Maximizing Safety and Savings: Tips for Smart Drivers

To maximize safety and savings while using both leased and owned vehicles for personal purposes, smart drivers should consider several proactive steps. Firstly, ensure comprehensive insurance coverage, including bobtail insurance, which is designed to protect against specific risks associated with towing or hauling. This additional layer of protection can significantly save on potential repair costs and legal liabilities, especially when engaging in activities like camping trips or moving furniture.

Additionally, regular vehicle maintenance checks are crucial. Well-maintained vehicles are less prone to breakdowns, reducing the risk of accidents and saving on emergency repairs. Drivers should also practice defensive driving techniques, such as maintaining a safe distance from other vehicles, adhering to speed limits, and staying alert during all times. These measures not only enhance safety but can lead to lower insurance premiums over time.

Protecting your vehicles, whether leased or owned, during personal use is a crucial aspect of responsible driving. By understanding the nuances of bobtail insurance coverage and leveraging strategies like maximizing safety and savings, you can ensure peace of mind on the road. Remember to review your policy details, consider additional protections, and stay informed about local regulations to make informed decisions that best suit your needs.